Manage your money with ezz

About this project

This project aims to create a solution for gen z’s in managing their money. This Ai personal finance assistance is a personalizes solution in which user can personalizes the app according to their need and with the help of the AI the process of managing money becomes very easy then it was ever was.

Problem statement

Financial literacy is crucial, but traditional financial tools can feel overwhelming for Gen Z. We're looking for an innovative solution that leverages AI to create a user-friendly personal finance assistant specifically for this tech-savvy generation.

What could be the actual problem?

The actual problem what I could figure out is that most of the existing app for managing money, budgeting or related to finance requires you manually enter all your transaction which for gen z could be a pain point due to low concentration power not just gen z but for everyone it could be annoying and boring to enter your transaction everyday or anytime you spend your money.

Possible solutions

We could make the bank transaction syn through the message that everyone receive after any transaction.

We can syn the UPI account of the user to track UPI payments directly within the app.

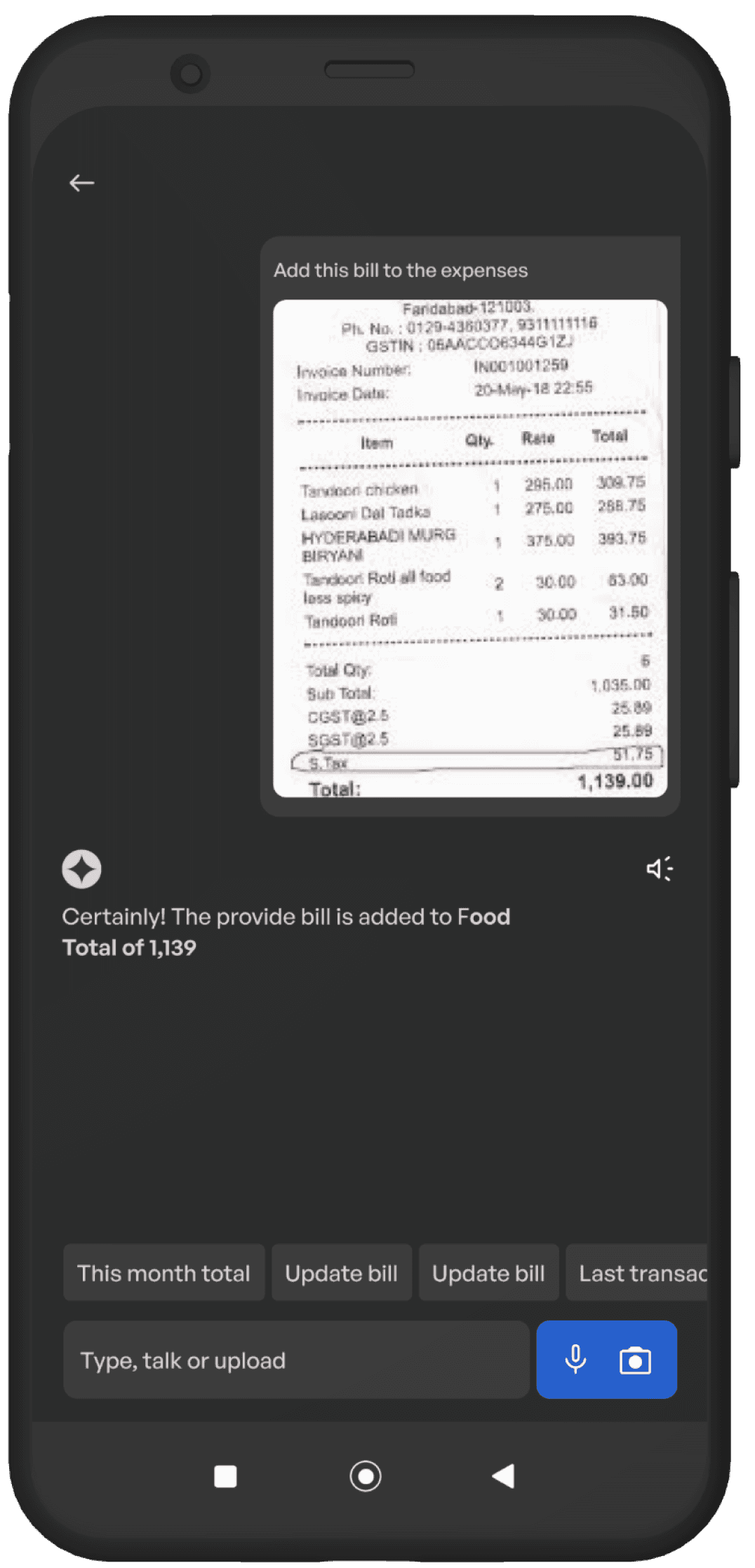

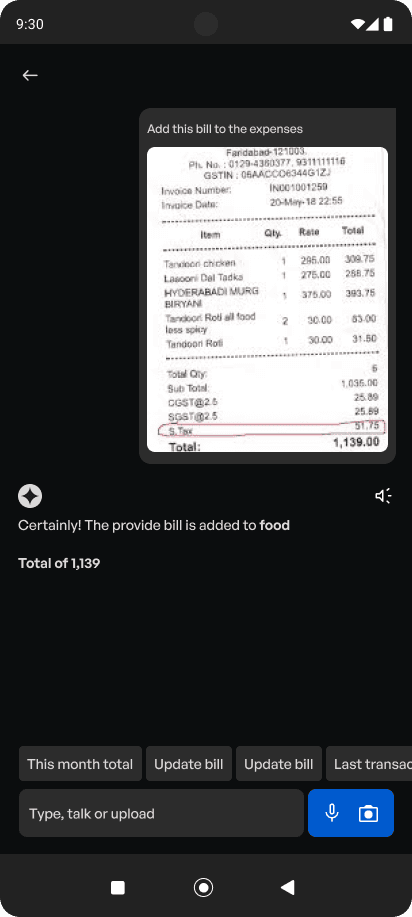

Users can scan or upload physical receipts or bills, and the AI automatically extracts relevant information and logs the expense.

Users can input expenses manually via a chat-based interface (AI-assisted) or through a traditional form.

What are the problem faced by Gen z managing their money

The existing apps are boring

Manual entry of transaction is very boring

I don’t get motivation to save

They need Personalization

Vibe of the app is not appealing

How I did my research?

The best way to conduct a secondary research is to go to the competetors or the exixtsing products review section in playstore. There I could point out few pain points of users.

01

Manual entry of transaction

Users are frustrated by the need for manual input of transactions, particularly in managing categories like merchant names.

02

Lack of Motivation

Users may find the app lacking in features that motivate them.

03

Usability

Need of easier and quicker navigation, especially for users wanting a more seamless interface for viewing daily, monthly, and yearly spends.

User Persona

Devyansh Singh

Age: 20

Occupation: B tech student (3rd year)

Location: Kolkata, West Bengal

Living Situation: Lives in a rented flat with two roommates

Bio

Devyansh is a college student in Kolkata, he lives in a shared flat with his flat mates. He receives a fixed monthly allowance from his parents to cover his living expenses, which includes rent, groceries, food, and college fees.

Frustration

Devyansh forgets to track small, daily expenses like snacks, transportation, and impulsive purchases.

He knows he should budget but doesn’t know how to start or stick to one.

At the end of the month, he often finds himself with no money left to put toward his laptop savings.

Goal

primary financial goal is to buy a high-end laptop for his coding projects and academic work.

He wants a way to track his day-to-day expenses so he can avoid overspending, particularly on food and other activities.

User journey map

Action

Task List

Emotion

Setting Budget

Uses the app’s Budgeting Tool to set spending limits for groceries, dining, rent, and miscellaneous expenses.

Creates a monthly budget:

₹2500 for groceries,

₹3000 for dining,

₹5000 for rent.

Creates a savings plan for the laptop, allocating ₹2000/month.

AI tracks expenses automatically and shows overspending warnings.

Receives notifications when approaching spending limits for dining out.

Gets encouragement from AI to save more.

🤩

Tracking Expenses

Opens the app regularly to check budget status.

Opens the app regularly to check budget status.

App tracks expenses automatically and shows overspending warnings.

App tracks expenses automatically and shows overspending warnings.

Receives notifications when approaching spending limits for dining out.

Gets encouragement from app to save more.

😁

Achieving Savings Goal

After months of budgeting and participating in challenges, he saves ₹70,000 for his laptop.

Celebrates savings success with a notification from the app.

Celebrates savings success with a notification from the app.

Gets a final congratulatory message from the app.

😤

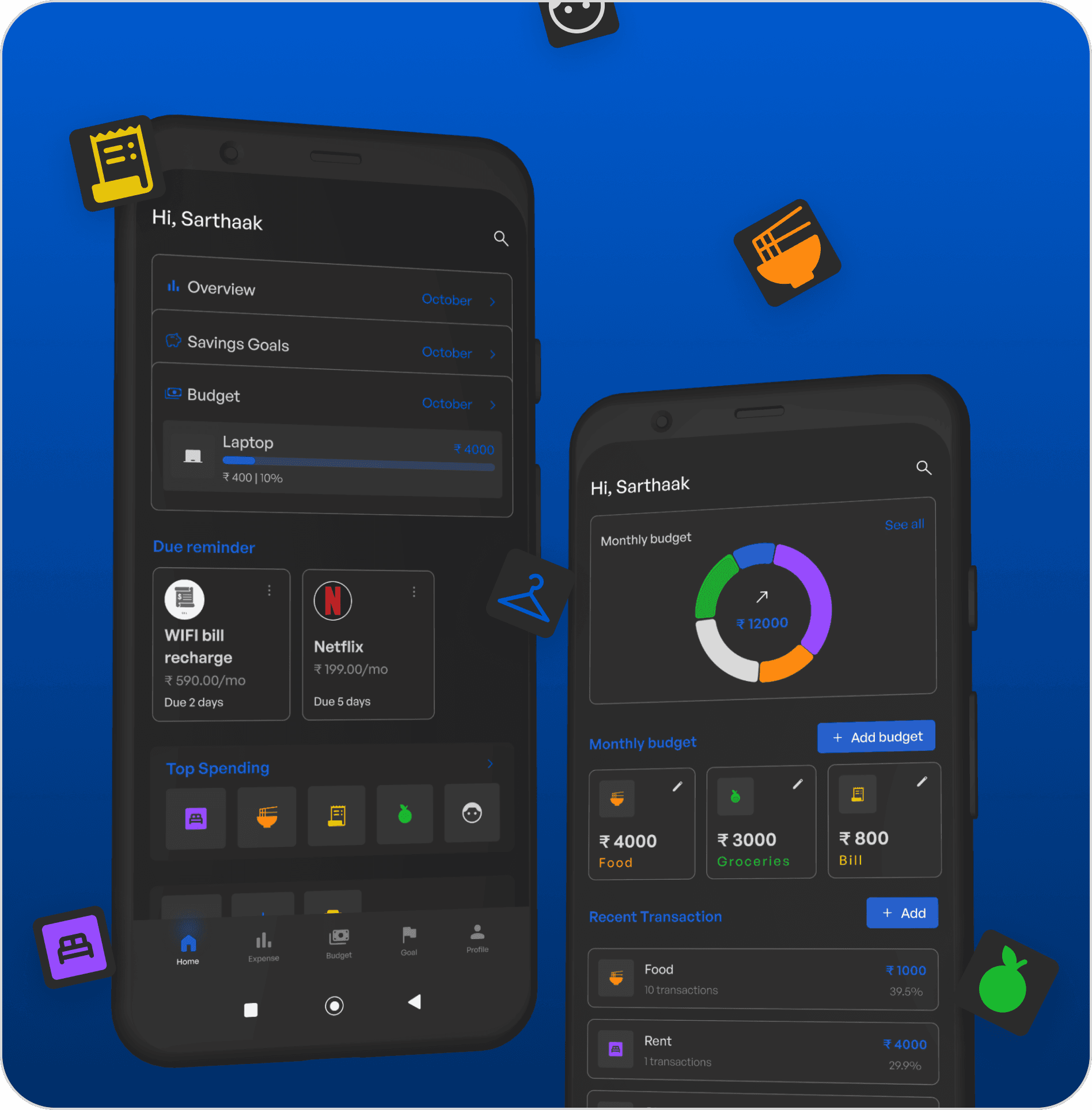

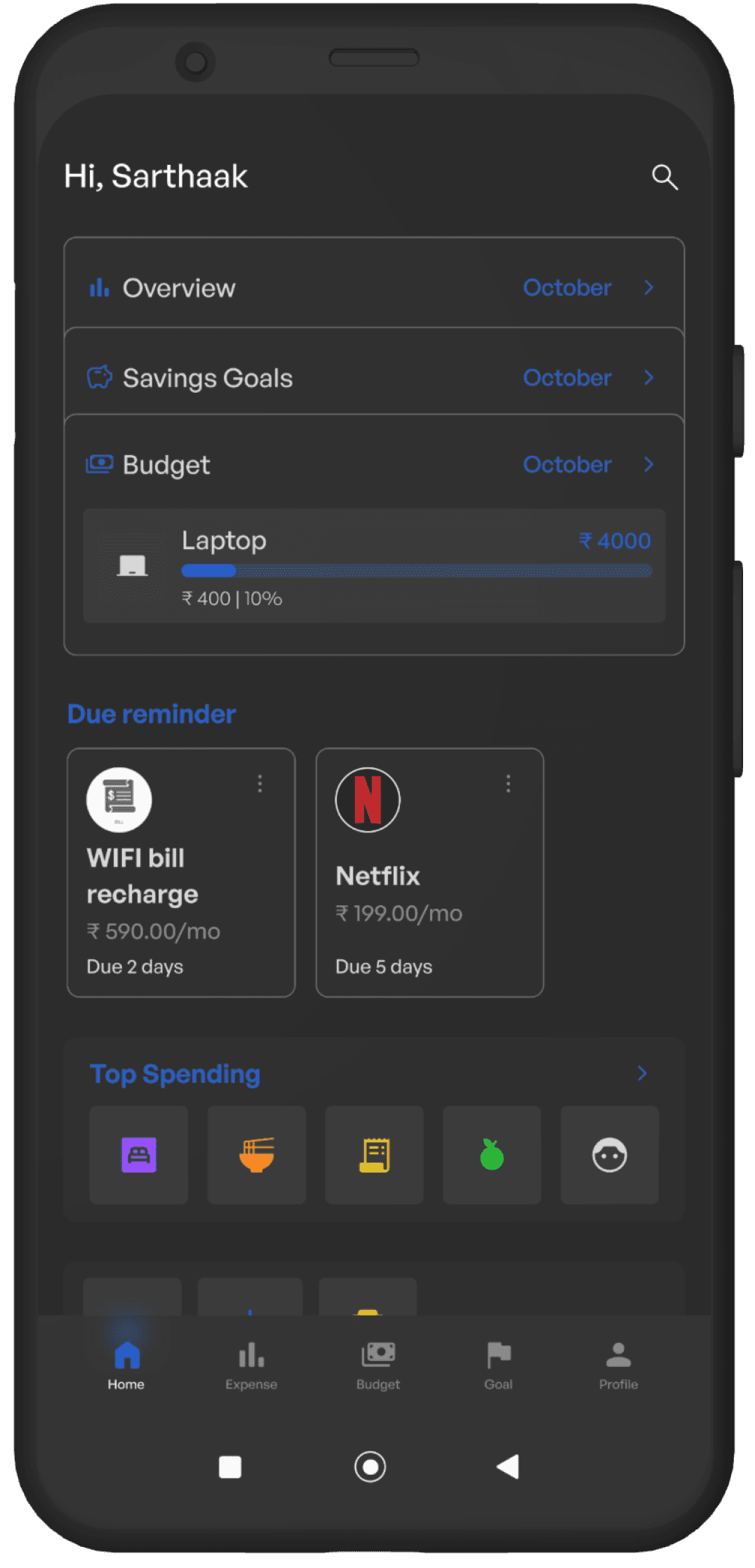

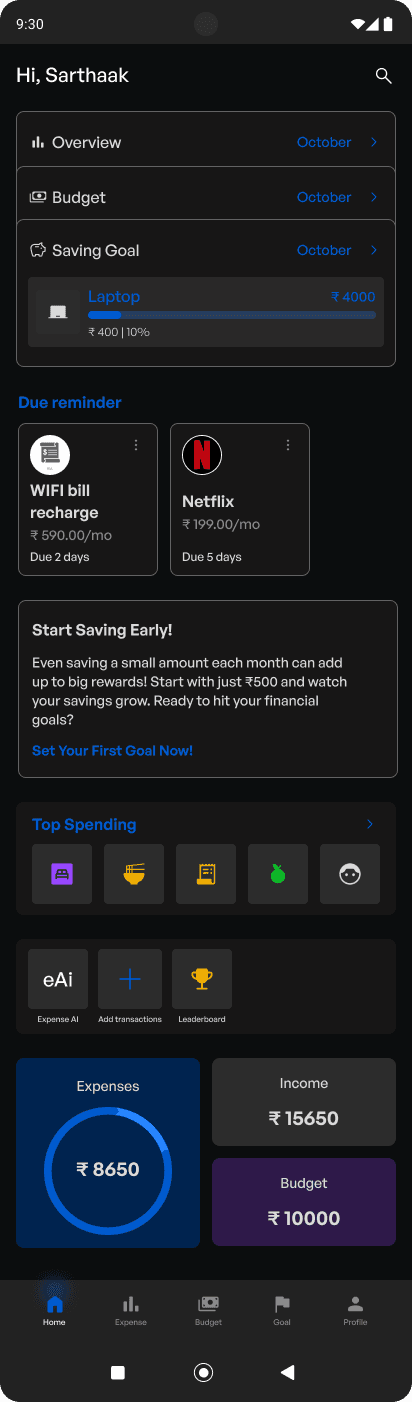

Due Reminder

In 2024 everyone of us specially Gen z’s have OTT platform subscriptions and other monthly subscriptions, due reminder helps the user to remind their monthly payments on time.

Sliding card

Entire app in 3 slides!

From this slides we can get a brief about what's going on with our money. Not every time we need to go to every specific page to check the stats.

Quick Actions

eAi(expense AI)

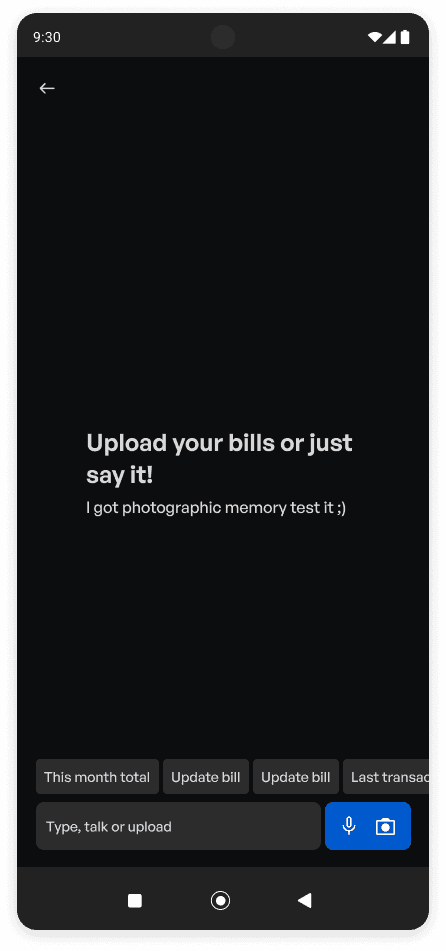

We all know how Gen z have a low concentration power which also with short contents we don’t like to spend extra time on an app regularly (Except Instagram obviously) and managing money is a very boring task with all the existing solutions also in the era of AI, where every one of us use AI in some form (I didn't) AI could be used to help in money management which will make the task quick and easy.

Leaderboard

How can we make money management fun?

Making it look like a competition can be one solution everyone love to complete with other. Healthy competition will not harm anyone but let you save more money🤑

Features

eAi

The most interesting part of this project in this era of AI where everyone used AI in some way in our day to day life then why not in managing our money we can use the memorizing power of AI in this as we can upload our bills in the AI or more convenient just speak it up, the category, place name and the amount that’s it no more manual typing your bills for which cannot be syn by your bank message or UPI. Just open the AI tell him your spending just like that you got your personal accountant

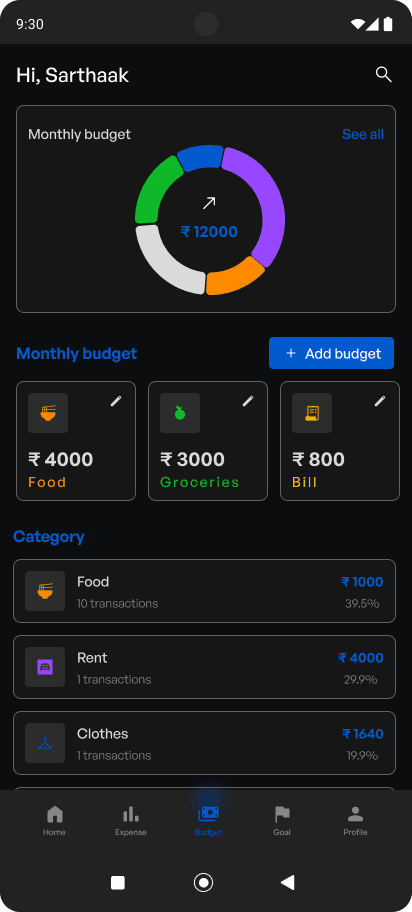

Monthly budget

In this section user can add their monthly budget with categories which helps to reduce the excess spending on any category.

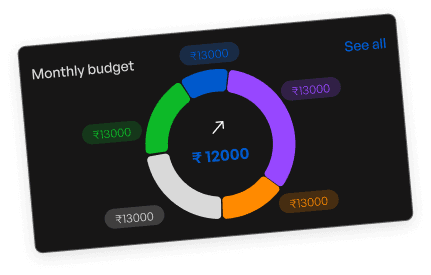

Pie Graph

This graphs visually represent the splits of percentage of all the categories in which money was spent

Category

In this section user can see which category has the highest spending and what is the percentage against the overall spending also user can see the number of transaction happed in that category.

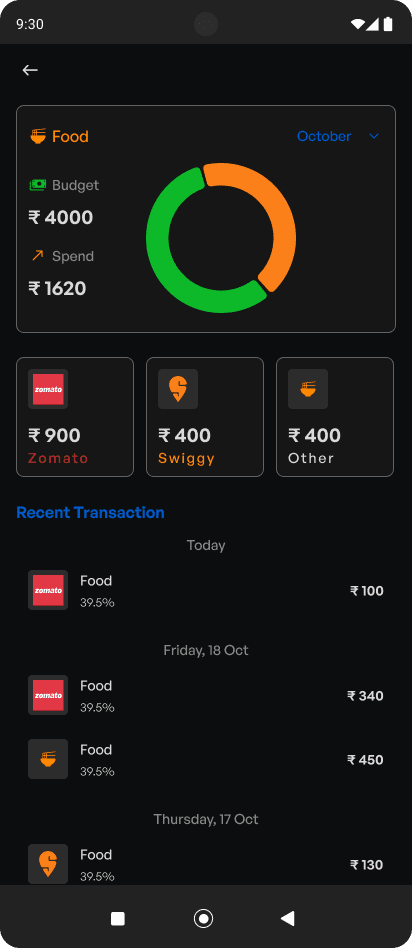

Highlights

In 2024 everyone orders most of their theirs food online (ex zomato & Swiggi) so why not sub categorize them so that they can get a clear picture of what amount is spend on which app.

Pie Graph

This graphs visually represent the amount spend and the actual budget

Recent transaction

The recent transactions shows all the transaction against food so that they can cross verify the total spend as we all tend to not check our balance before ordering:’)